What is the calculation and application of GST?

Real11 has altered the deposit system effective October 1, 2023, as per the new 28%

Government

Tax (GST).

GST will now be applicable on all deposits.

Regardless of that, you can always participate in contests with the full amount you add.

Don’t worry!

For instance, once you add ₹100, you can play for the full amount of ₹100.

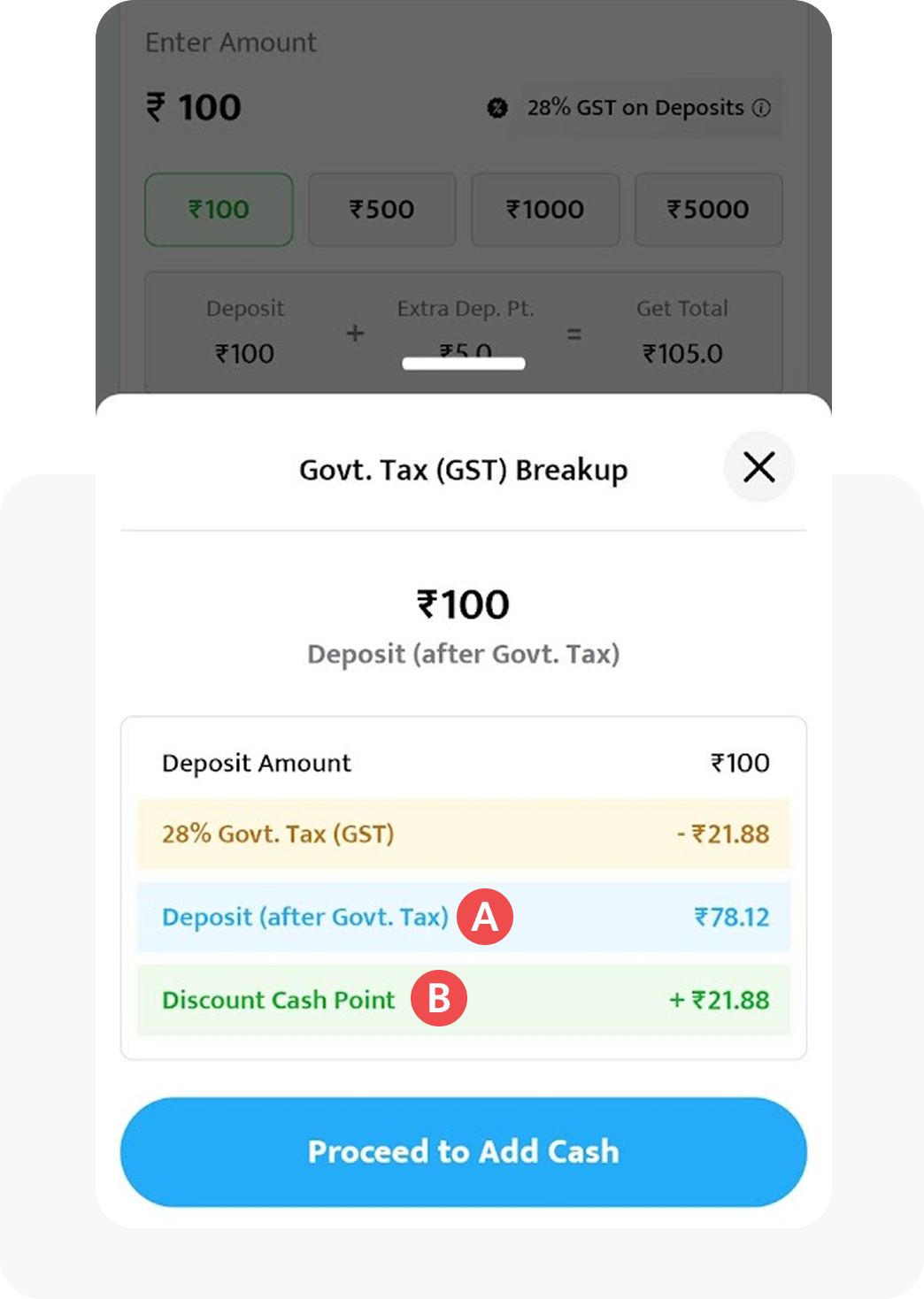

So, how does the Deposit flow work?

When you deposit ₹100 into your account, you will receive ₹78.12 initially

as

your Deposit Amount

(A), and the GST

on that amount is 21.88 (28% of 78.12).

You will, however, be offered Discount Cash Points (B) amounting to 28% percent of your Deposit Amount, or

₹21.88.

So, Deposit Amount (A) + Deposit Cash Point (B) = ₹78.12 + ₹21.88.

Thus current balance added would be ₹100.

These discount cash points can be later used to join real money contests on Real11.

What happens to the deducted entry fee after the GST changes?

After all other available discounts are applied, 30% of any Contest Entry will be removed from your

Discount

Cash

Points balance.

Note: Discount Points expire after 90 days of credit, and they are not refundable.

How do I verify the amount of GST deducted?

The Government of India has introduced an amendment in its taxation legislation, and GST will be imposed at a

rate

of 28% on the sum that a user deposits.

The change was effective on 1 October 2023.

To see your GST deductions:

1. Click your profile picture in the top left corner.

2. Select My Wallet and then download the Statement for the time period you wish.

3. Transaction history will be sent to the registered Email ID updated on Real11.

This will provide you with the deposit-wise GST deductions and the account balance.

Moreover, you can learn about the Discount Points received per deposit since October 1, 2023.

If you require any additional assistance, feel free to reach us here support@real11.com